Pay me now or pay me later

BCC wrestles with impact fees to help pay for rapid growth

GREEN COVE SPRINGS – The Board of County Commissioners heard from residents and business owners on the plan to impose an impact fee to keep pace with the county’s rapid growth. The proposed fees …

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, below, or purchase a new subscription.

Please log in to continueDon't have an ID?Print subscribersIf you're a print subscriber, but do not yet have an online account, click here to create one. Non-subscribersClick here to see your options for subscribing. Single day passYou also have the option of purchasing 24 hours of access, for $1.00. Click here to purchase a single day pass. |

Pay me now or pay me later

BCC wrestles with impact fees to help pay for rapid growth

GREEN COVE SPRINGS – The Board of County Commissioners heard from residents and business owners on the plan to impose an impact fee to keep pace with the county’s rapid growth. The proposed fees would be applied to cover the expansion of services that would meet the continual needs of county residents.

Developers and some business owners said on Monday the fee would impair growth; while many residents said they are tired of footing the bill for expanding roads, schools and infrastructure projects. A final vote is scheduled for the Dec. 13 regular BCC meeting.

A development impact fee is defined as a one-time charge that is imposed at the time that a building permit is issued. The fee is placed on all development projects within a defined geographic area, with coffers going towards funding facilities that would accommodate new development.

A six-step process methodology is utilized to plan calculations for the impact fee, which was laid out during an opening presentation in the meeting. This includes estimating the existing development and future growth, identifying the facility standards, determining the facility needs and costs, allocating the cost share to accommodate the growth, identifying alternative funding needs, and finally, calculating a fee by allocating the cost for each unit of the development.

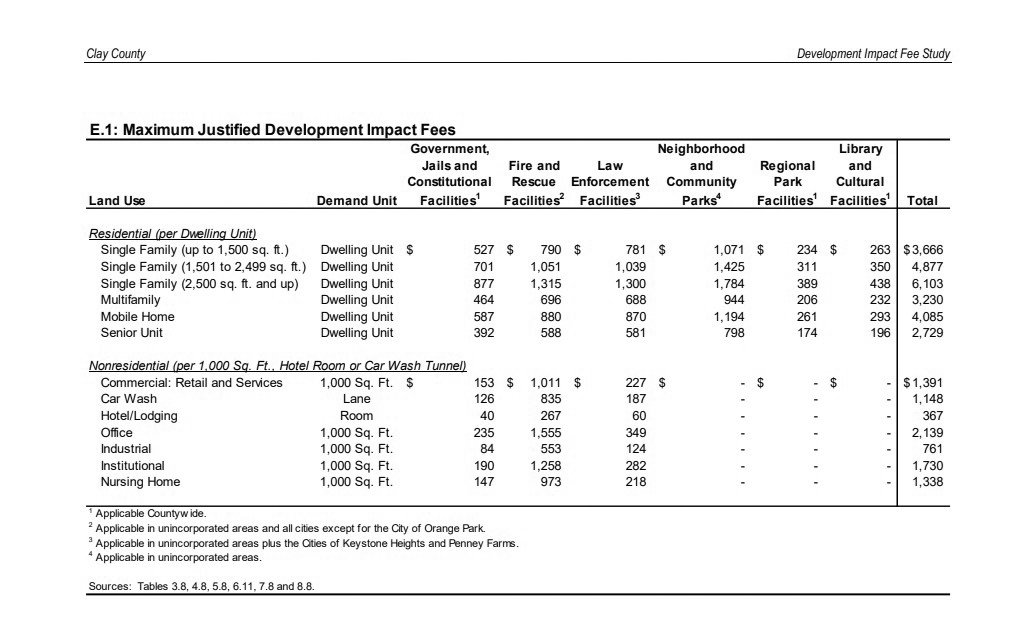

Six categories exist for impact fees: government, jails, and constitutional facilities, fire and rescue facilities, law enforcement, community and neighborhood parks, regional parks, and library and cultural facilities.

Three types of calculations are calculated to create the numbers used in the report: existing inventory, planned facilities, and the system plan.

The workshop was to discuss the impact fee is likely a result of the pressing issue of the increasing level of growth and development in the county.

The issue has been a hot topic largely in part due to a major projected spike in growth and development that the county will likely see by 2045 due to an increasing number of new residents.

That number is projected to increase greatly over the next 23 years, according to the Clay County Development Impact Fee Study Administrative Draft, which was provided by the county government for the meeting and future use.

The study projects that the estimated number of full-time residents will jump from 221,440 in 2021 to 278,300 in 2045, an increase of 56,860. If the projection were to prevail, the figure would total a 25.7% influx of new residents within county borders, according to the study.

Meanwhile, the number of employees working in Clay County could see an even higher increase. An estimated number of 54,412 workers in 2021, is projected to skyrocket to 156,073 by 2045. With an increase of 101,661 employees, the percentage would spike by 186.8%, the study suggests.

The county said $227,066,840 of outside additional funding, not including development fee revenue, would be required during the next 23 years if the plan is implemented. According to the county’s study for the following categories: fire and rescue facilities ($90,492,882), law enforcement facilities ($79,115,272), neighborhood and community parks, ($23,615,483) and regional parks ($33,843,203).

Meanwhile, development fee revenue would account for $20,503,000 for government, jail, and constitutional facilities, $62,248,500 for fire and rescue facilities, $25,339,728 in law enforcement facilities, $24,249,000 in neighborhood and community parks, $5,856,580 for regional parks, and $6,595,760 for library and cultural facilities, totaling $144,792,568.

The regional park fee would be county-wide and not split among jurisdictions.

The net project cost combining development fee revenue and required additional funding would total $371,859,408 for Clay County.

No additional funding would be required for government, jail, and constitutional facilities along with libraries and cultural facilities. The Library and Culture Facility fee will maintain the same level of service provided, but it should be noted that it is below the recommended level for the state of Florida.

As residents continue to relocate to Clay, the county has already seen a 40% increase in service calls from 2015-2022.

“I will tell you, we’re straining at the seams right now, and anything beyond (the current rate) is going to exceed our capacity without major changes to the service,” said Lorin Mock, Fire Chief for the Clay County Department of Public Safety.

Clay County has only added one rescue unit and one part-time unit since the 2017-18 budget.

Still though, at least four new fire stations are planned to be rebuilt, including Lake Asbury (Station 18), Green Cove Springs (Station 20), Fleming Island (Station 22) and Virginia Village (Station 24). Eight total new fire stations are planned for the future, according to Mock.

Meanwhile, law enforcement facilities, which are projected to cost a total of $104,455,000 for service area-only allocation, will also need increased services and infrastructure to meet demands, as an increase in future officers and equipment would be required for the Clay County Sheriff’s Office to meet their set response time goals.

For example, residents living in a 2,000-square-foot single-family dwelling could pay between $12,729 and $19,111 in impact fees, with the low and high estimates depending on the fee zones in each jurisdiction.

For example, residents living in a 1,581 to 2,499-square-foot single-family dwelling would dish out a maximum justified impact fee schedule payment of up to $4,877.

Meanwhile, a commercial retail and services office could pay as much as $1,391, according to the maximum justified fees schedule.

You can access the Clay County Development Impact Fee Study Administrative Draft by following this link and downloading the agenda: https://claycounty.novusagenda.com/agendapublic/.